Undergraduate

Undergraduate (Global)

Postgraduate

Executive

Family Business

Careers

Innovations

Faculty

MU Ventures

Enterprise Education

Student Life

Jobs

Become a Master

events

For Companies

Blog

Check Your Fitment

Please Check the input

Please Enter Valid Email

Please Enter Valid Number

Download Brochure

Please Check the input

Please Enter Valid Email

Please Enter Valid Number

Got it

Your download will begin shortly.

Become a

Market

Trader with

PGP in Capital Markets & Trading

- 12-month hybrid programme (MBA Equivalent)

- Invest and Trade with Rs 40L Real Capital

- Get 1:1 Mentorship from Industry Traders

- 12-month hybrid programme (MBA Equivalent)

- Invest and Trade with Rs 40L Real Capital

- Get 1:1 Mentorship from Industry Traders

- 12-month hybrid programme (MBA Equivalent)

- Invest and Trade with Rs 40L Real Capital

- Get 1:1 Mentorship from Industry Traders

- 12-month hybrid programme (MBA Equivalent)

- Invest and Trade with Rs 40L Real Capital

- Get 1:1 Mentorship from Industry Traders

PGP in

Capital Markets

& Trading

Format

Blended

Online/In-Person Weekend

Classes

Commencement Date

April'26

Designed For

Investors

Traders, Brokers, Analysts & Asset Managers

Duration

12 Months

Incl. 2 Immersions

Designed For

Traders,

Investors, Brokers,

Analysts & Asset Managers

Learn 8 Major Financial Instruments

Equity | Debt | Derivatives | Crypto | Forex | Commodities | Real Estate | Hybrid Instruments

Master Modern Trading Tools

MetaTrader 4/5 | R | Python | MATLAB

Exposure to Trading Strategies

Scalping | Day Trading | Swing Trading | Momentum Trading | Mean Reversion

Build Algorithmic Models & Simulations

TWAP | VWAP | Iceberg Orders | Monte Carlo Simulations | Black-Litterman Model

Understand Risk & Compliance

VaR Models | Stress Testing | SEBI | IPA | MiFID II | SEC

Learn 8 Major Financial Instruments

Equity | Debt | Derivatives | Crypto | Forex | Commodities | Real Estate | Hybrid Instruments

Master Modern Trading Tools

MetaTrader 4/5 | R | Python | MATLAB

Exposure to Trading Strategies

Scalping | Day Trading | Swing Trading | Momentum Trading | Mean Reversion

Build Algorithmic Models & Simulations

TWAP | VWAP | Iceberg Orders | Monte Carlo Simulations | Black-Litterman Model

Understand Risk & Compliance

VaR Models | Stress Testing | SEBI | IPA | MiFID II | SEC

Learn 8 Major Financial Instruments

Equity | Debt | Derivatives | Crypto | Forex | Commodities | Real Estate | Hybrid Instruments

Master Modern Trading Tools

MetaTrader 4/5 | R | Python | MATLAB

Exposure to Trading Strategies

Scalping | Day Trading | Swing Trading | Momentum Trading | Mean Reversion

Build Algorithmic Models & Simulations

TWAP | VWAP | Iceberg Orders | Monte Carlo Simulations | Black-Litterman Model

Understand Risk & Compliance

VaR Models | Stress Testing | SEBI | IPA | MiFID II | SEC

Learn to

Build a Diversified

Portfolio

Explore Course Modules

Crypto

Real Estate & VC

Risk & Hedging

Commodities & Forex

Derivative Markets

Equity Markets

Equity Markets

Derivative Markets

Commodities & Forex

Risk & Hedging

Real Estate & VC

Crypto

How to Trade Stocks like an Expert

How do markets work and how to master the capital markets ecosystem

How to select the right financial instrument and evaluate investments using risk-return metrics

How to comply with global regulatory standards

How to master the opening bell

How to Safely use Derivatives

How to assess a company's true value

How to get started with futures, options and the greeks

How to hedge risks with covered calls and protective puts

How to protect portfolios using derivatives

How to predict market trends using charts and indicators

How to execute trades with proven day trading strategies

How to Diversify into Commodities & Forex

How to trade commodities and understand pricing mechanisms

How to trade forex pairs and leverage spot, forward and swap markets

How to apply advanced indicators to forex and commodities

How to minimize losses with strategic hedging

How to assess macroeconomic impact on markets

How to apply VPA & Camarilla Pivots

How to ‘Hedge’ Your Portfolios

How to stress-test your portfolio with VaR and Scenario Analysis

How to use exotic derivatives for complex scenarios

How to manage portfolios with dynamic hedging

How to unlock investment opportunities with CDOs and ABS

How to apply volatility metrics in risk management

How to design Stochastic Models for risk assessment and scenario planning

How to Buy Real Estate & Invest in StartUps

How to identify opportunities in REITs

How to diversify portfolios with alternative investments

How to invest sustainably with ESG metrics and green bonds

How to leverage urbanisation and tech-driven trends in real estate

How to overcome cognitive biases for smarter investment decisions

How Not to Lose Money with Crypto

How to master the basics of blockchain and cryptocurrencies

How to trade crypto like a pro: advanced strategies and risk management

How to master bitcoin and ethereum trading

How to analyse global capital flows

How to navigate taxation and risks in global investments

Learn through Application,

Not Just by Sitting in

Class

Invest and Trade with

Rs 40L Real Capital

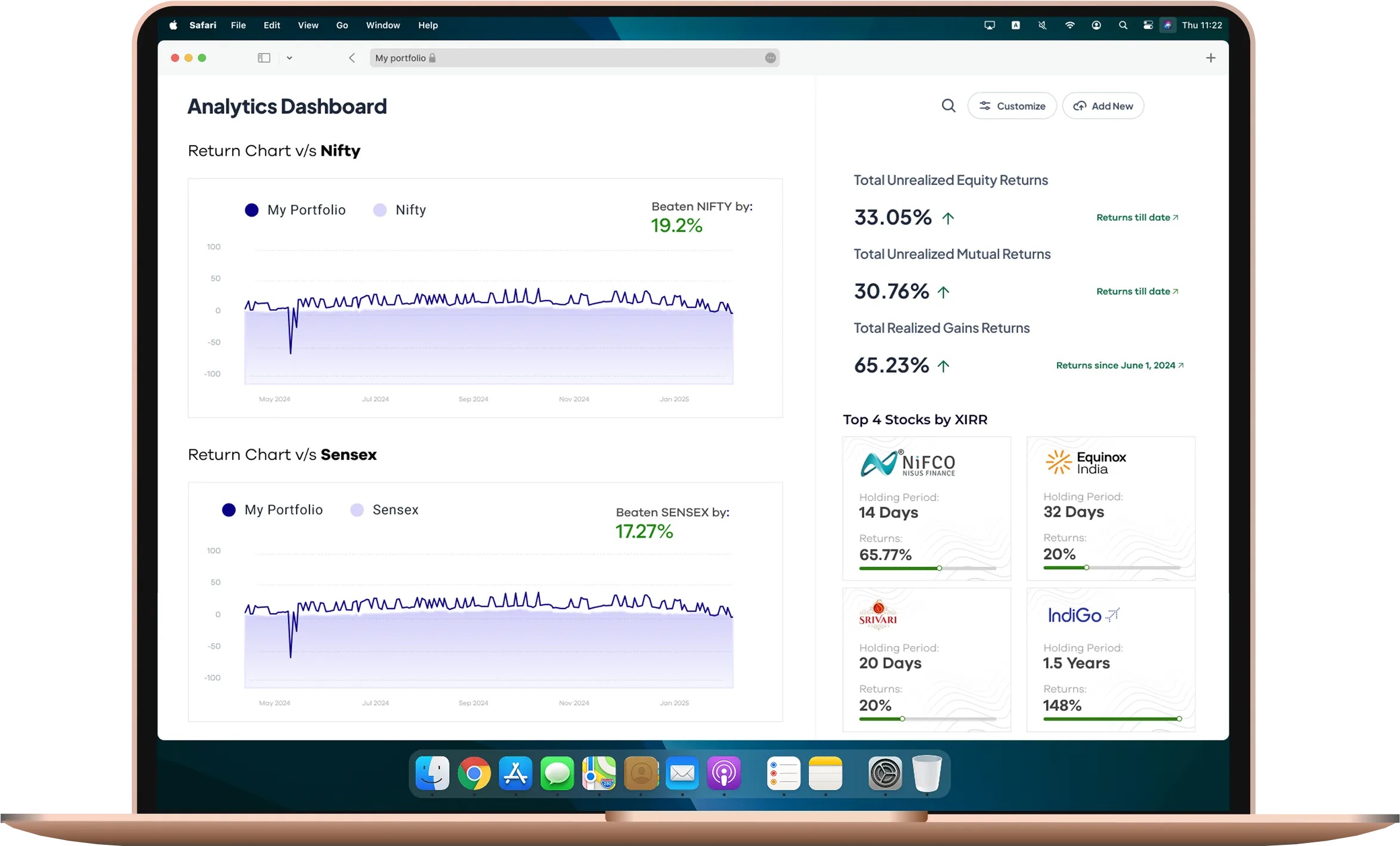

Backed by a ₹40 Lakh fund from Masters’ Union, students actively invest in public markets—making real decisions with real money. Over 3 years, they’ve outperformed both Sensex and Nifty, delivering a 53% realized gain

Establish Your Own

Wealth Management

Firm

From compliance to client acquisition, learn how to establish, manage and grow a wealth management firm with a real-world pilot programme

Target to get ₹10 Cr. in AUM within 1 year

Learn how to sell to funds & LPs

Network with & raise capital from HNIs

1:1 Coaching with

Market Gurus

Get personalized guidance from top mentors and traders empanelled by Masters’ Union

Experts include experienced traders & hedge fund managers

Avoid mistakes & get your portfolios reviewed continuously

Build long-lasting trader relationships beyond the programme

Build Your Personal Brand

as a Trading Expert

Use financial expertise to create authentic, monetisable content and build a trusted online presence

Publish your own podcast on Youtube & Instagram

Start an expert series on X or LinkedIn

Generate investor interest organically

Invest and Trade with

Rs 40L Real Capital

Backed by a ₹40 Lakh fund from Masters’ Union, students actively invest in public markets—making real decisions with real money. Over 3 years, they’ve outperformed both Sensex and Nifty, delivering a 53% realized gain.

Establish Your Own

Wealth Management

Firm

From compliance to client acquisition, learn how to establish, manage and grow a wealth management firm with a real-world pilot program.

Target to get ₹10 Cr. in AUM within 1 year

Learn how to sell to funds & LPs

Network with & raise capital from HNIs

1:1 Coaching with

Market Gurus

Get personalized guidance from top mentors and traders empanelled by Masters’ Union

Experts include experienced traders & hedge fund managers

Avoid mistakes & get your portfolios reviewed continuously

Build long-lasting trader relationships beyond the program

Build Your Personal Brand

as a Trading Expert

Use financial expertise to create authentic, monetisable content and build a trusted online presence

Publish your own podcast on Youtube & Instagram

Start an expert series on X or LinkedIn

Generate investor interest organically

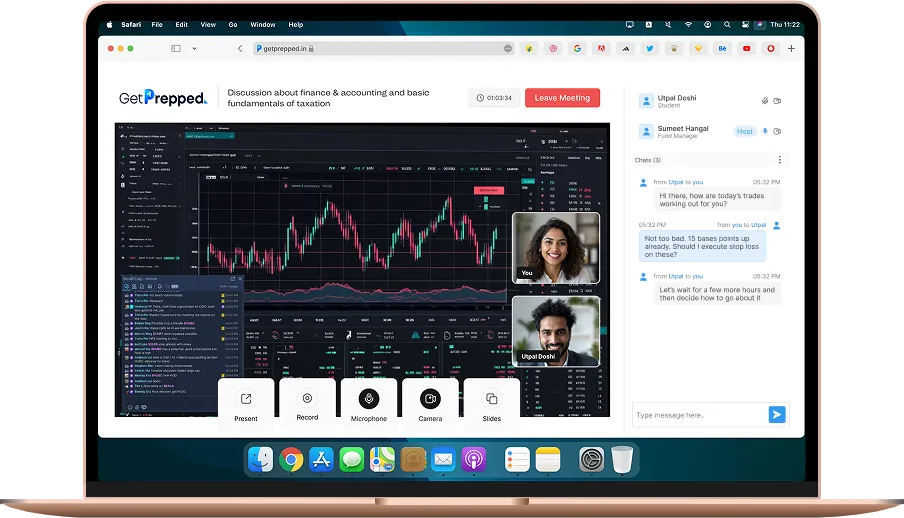

Trade with Our Expert Community

Become a part of our deeply engaged trading community consisting of fellow traders, teachers & experts.

Get feedback on trades before executing

Get real-time insights on markets from industry experts

Make faster & more confident decisions on your daily trades

“What are derivatives?”

“How to select stocks?”

“How do I hedge risks ?”

Masters’ Union

x Upstox:

Bringing Real Markets into the Classroom

Upstox partners with Masters’ Union to deliver India’s first structured trading education where expert-led learning replaces guesswork.

- Upstox experts co-design curriculum and deliver live market walkthroughs.

- Structured learning framework replacing influencer-based trading advice.

- Real capital trading experience with regulated mentorship and accountability.

Masters’ Union

× StockEdge

Data-Driven Trading for Real Market

Execution

StockEdge partners with Masters’ Union to deliver structured trading education powered by NSE & BSE data, focused on market context, execution, and risk management.

- StockEdge experts will coach on intraday & short-term trading frameworks.

- Data-backed decision-making using price, volume, and volatility.

- Focus on execution, risk management, and trade evaluation .

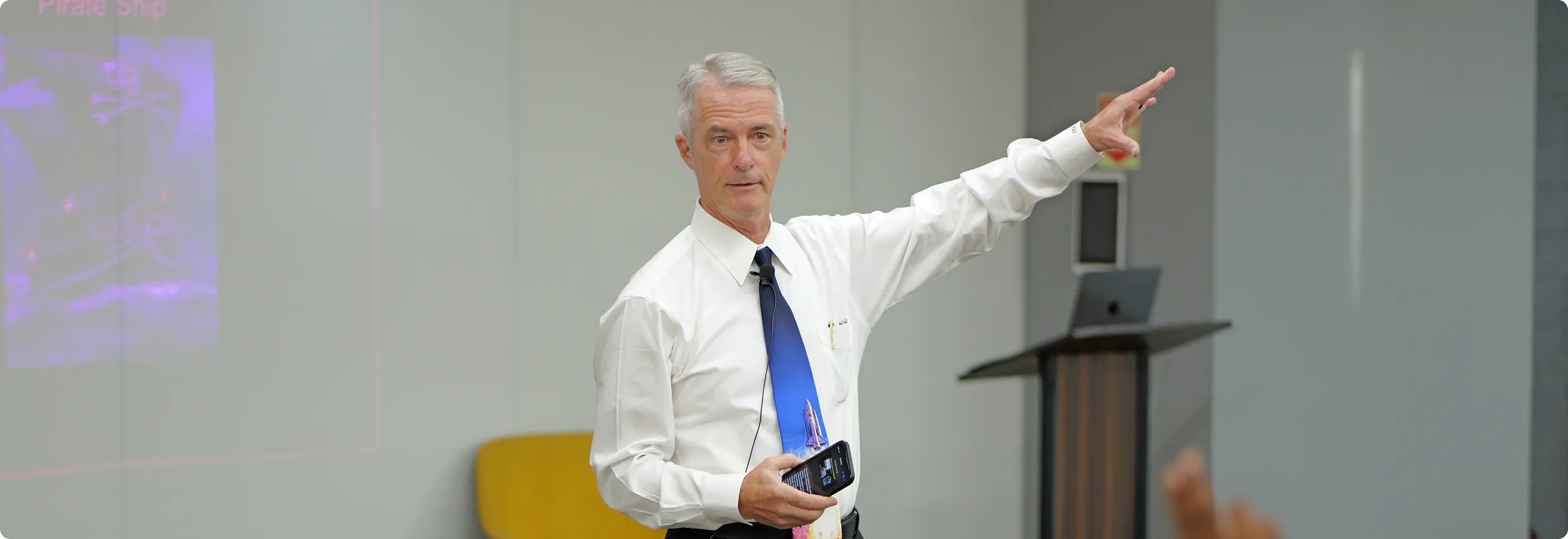

Learn from Real Traders & Market Gurus. Not Just Whatsapp.

Courses taught by 20+ real practitioners across instruments

Access to exclusive guest sessions from top hedge fund managers

Engage in live Q&A sessions with renowned economists

1:1 consultation with experts from NSE, Barclays and more

Nikhil Rungta

Co-Chief Investment Officer

How to assess a company's true value

Aman Singhania

SVP & Head, Financial Products

How to diversify portfolios with alternate investments

Kunal Bothra

Consultant, Market Expert

How to execute trades with proven day trading strategies

Venkatachalam Srivatsa

Executive Vice President

How to evaluate investments using risk-return metrics

Siddhartha Rastogi

Managing Director

How to master the capital markets ecosystem

Vaibhav Jain

Partner, Investments

How to select the right financial instrument

Arnab Ghosh

Fmr. Director, Operations & Risk

How to leverage private equity & venture capital strategies

Neeraj Gupta

Corporate Trainer

How to get started with futures, options, and the greeks

Abhishek Gupta

Former VP, Market Risk

How do capital markets work

Rajesh Madhavan

Visiting Faculty, Investments

How to overcome cognitive biases for smarter investment decisions

Payal Jain

Partner

How to master debt trading

Vijaya Bhaskar Marisetty

Former Associate Professor

How to comply with global regulatory standards

Himanshu Jain

Co-Founder

How to analyze global capital flows

Aswini Bajaj

Visiting Faculty, Investments

How to apply volatility metrics in risk management

Disclaimer: *The final list of masters may vary depending on their availability and programme requirements.

Masters’ Union Investment Fund Real Investment , Real Results

A student-managed fund that provides hands-on investment experience across diverse asset classes, including equities, crypto, real estate, and startups.

Watch Video

Masters’ Union Investment Fund

Real Investment, Real Results

A student-managed fund that provides hands-on investment

experience across diverse asset classes, including equities,

crypto, real

estate, and startups.

Fund Portfolio Performance

What You’ll Walk Away With

-

1

The skills to trade like a professional, not a gambler.

-

2

Confidence to make trading decisions independently.

-

3

Deep understanding of global financial fluctuations.

-

4

Skills to build your own fund or a wealth management firm.

-

5

Avoiding hearsay & tips from WhatsApp and Telegram channels.

Disclaimer: The Capital Markets Course by Masters’ Union is for educational purposes only and does not provide stock tips, trading calls, or investment recommendations. Any views shared by instructors, speakers, or participants are their own and do not represent Masters’ Union. Participants should do their own research, seek SEBI-registered financial advice, and comply with SEBI regulations before making any financial decisions. Masters’ Union assumes no liability for any financial actions taken.

Get in Touch

Admissions Office

Mobile no.

Working Hours - Monday- Saturday, 11:00 am- 7:00 pm IST

A Practitioner-Led

Curriculum for the Traders

Designed with insights from top traders, economists, and portfolio managers, the curriculum offers hands-on trading exposure. Each term is a combination of InClass learning, OutClass applications, tool-based training, and capstone experiences.

Enabling You to Excel

Inside and Outside the Classroom

Foundations of Capital Markets

- InClass

- OutClass

- Tool Training

- Capstone Project

How to Master the Capital Markets Ecosystem

- Key market participants and their roles: brokers, exchanges, investors, institutions, and regulators

- How prices move: bids, offers, demand–supply shifts, market depth, and price bands

- Trading mechanics: order types, and volatility controls

- Index structure and behaviour: how indices reflect market sentiment and momentum

How to select the right financial instrument

- Risk-Return Optimization: Using the Efficient Frontier to Select Instruments

- Asset Allocation Mastery: Diversifying with Stocks, Bonds, and Derivatives

- The Art of Risk Profiling: Aligning Instruments with Your Investment Goals

How to Assess a Company's True Value

- Key components of financial statements and major profitability, leverage, and valuation ratios

- Core valuation approaches including DCF and relative multiples

- Earnings trends, quarterly result interpretation, and basic forecasting inputs

- Peer comparison frameworks and industry benchmarking for equity evaluation

Equity Hackathon with MUIF

- Invest & Trade with Masters' Union Investment Fund with real corpus of INR 40 Lacs on MU's Demat Account

- Design and execute equity valuation and trading strategies.

- perform equity valuations, select derivative strategies, and present risk mitigation approaches.

TradingView & Chartink

- Identify market trends using charts and core indicators

- Analyze price movements with drawing tools and trendlines

- Create and track personalized watchlists for selected securities

The Trading Strategy & Execution Challenge

- Execute systematic, rules-based trades with documented entry–exit logic, risk limits, and disciplined journaling.

- Review outcomes using both absolute returns and risk-adjusted metrics to evaluate trading performance.

Equity and Derivative Markets

- InClass

- OutClass

- Tool Training

- Capstone Project

How to Build, Test and Execute Quants Trading Strategies

- Market data essentials, return computation and volatility basics

- Core trading signals: momentum, mean reversion and seasonal patterns

- Designing systematic entry–exit rules and execution logic

- Backtesting foundations and risk-controlled portfolio sizing

How to Get Started with Futures, Options, and the Greeks

- Futures Unleashed: Leveraging market positions

- Options Anatomy: Calls, Puts, and basic strategies

- The Greeks Decoded: Delta, Theta, Gamma, and Vega

- Risk-Reward Optimization: Enhancing trade precision

How to Protect and Hedge Portfolios with Derivative Strategies

- Covered Calls, Protective Puts, and Collars for basic hedging

- Volatility strategies including Straddles, Strangles, and Long Vol trades

- Multi-leg neutral structures such as Iron Condors and Butterflies

- Futures, swaps, and risk-parity concepts for portfolio-level risk control

Creatorpreneur: Mastering Content Creation in Capital Markets

- Identify a specific niche within capital markets.

- Establish a personal brand on platforms like LinkedIn, YouTube, and Meta.

- Simplify complex financial concepts through effective storytelling.

Python for Financial Data Analysis

- Write and execute Python programs using variables, loops, and functions

- Import, clean, and analyze datasets using Pandas and NumPy

- Visualize financial data and trends using Matplotlib and Seaborn

Event Based Trading Strategy

- Evaluate event impact and design a matching derivatives strategy.

Commodities and Forex Trading

- InClass

- OutClass

- Tool Training

- Capstone Project

How to trade commodities and understand pricing mechanisms

- Market Drivers: Supply-demand, geopolitics, weather

- Commodity Futures Trading: Contract structures, margin calls, rollover strategies

- Commodity Hedging: Using futures and options to hedge price risks

- Technical Analysis: MACD, RSI, chart patterns for timing trades

- Fundamental Analysis: EIA & CFTC Reports, production, geopolitical events

How to Trade Forex Pairs and Leverage Spot, Forward, and Swap Markets

- Master spot, forward, and swap currency markets for trading and hedging

- Apply carry, contrarian, and pairs trading strategies effectively

- Manage leverage, spreads, and margin risks for optimal positioning

- Use Bollinger Bands, Fibonacci, and MA crossovers to time entries and exits

How to Apply Advanced Indicators to Commodities

- Trade momentum with RSI, MACD, and stochastic oscillators

- Identify volatility breakouts using Bollinger Bands and mean reversion

- Map trend corrections with Fibonacci retracements and extensions

- Confirm signals using volume and money flow indicators

Creatorpreneur: Mastering Content Creation in Capital Markets

- Expand reach using social media strategies, SEO, and collaborations.

- Research and secure at least one brand partnership aligned with your niche.

- Implement refined content strategies across multiple platforms.

- Present a comprehensive content portfolio during the final demo day.

Python for Financial Data Analysis

- Use APIs and web data to extract and analyze market information

- Build financial models (returns, moving averages, correlations)

- Automate trading or analytical tasks using Python scripts

Macro–Asset Mapping, Correlation Analysis, and Trade Expression Using Commodities and Forex

- Map macroeconomic regimes to commodity and currency trends.

Advanced Risk Management and Derivatives

- InClass

- OutClass

- Tool Training

- Capstone Project

How to Stress-Test Your Portfolio with VaR and Scenario Analysis

- Model 1: Historical VaR Simulation

- Model 2: Monte Carlo Simulation for Risk

- Model 3: Parametric VaR (Variance-Covariance)

- Model 4: Stress Testing with Hypothetical Shocks

- Model 5: Scenario Analysis with Tail Risks

- Model 6: Backtesting VaR Models

- Model 7: Conditional VaR (CVaR) Application

- Model 8: Factor Sensitivity Testing

- Model 9: Multi-Factor Stress Testing

- Model 10: Extreme Event Simulation

How to use exotic derivatives for complex scenarios

- Barrier Options

- Asian Options

- Lookback Options

- Spread Options

- Quanto Options

- Swaptions

- Compound Options

- Cliquet Options

- Digital Options

- Forward Start Options

How to Manage Portfolios with Dynamic Hedging

- Delta Hedging

- Gamma Scalping

- Vega Hedging

- Theta Management

- Portfolio Insurance Strategy

- Constant Proportion Portfolio Insurance (CPPI)

- Dynamic Rebalancing

- Risk Parity Approach

- Volatility Targeting

- Time-Weighted Hedging

WealthPreneur: Build Your Own Wealth Management Firm

- Regulatory Compliance and Business Planning

- Understand SEBI Regulations: Study SEBI guidelines to ensure legal compliance.

- Develop Business Plan: Outline mission, services, target market, and revenue models.

- Establish Legal Entity: Choose appropriate legal structure and complete necessary registrations.

- Design Operational Framework: Set internal policies and compliance protocols.

MATLAB Computational Finance Suite - MATLAB & Simulink

- Perform data analysis, visualization, and matrix operations in MATLAB

- Build mathematical and financial models using scripts and functions

- Simulate dynamic systems using basic Simulink blocks and workflows

Integrated Risk Management and Hedging Framework for a Derivatives Portfolio

- Quantify the portfolio’s initial risk, apply layered hedging strategies, and demonstrate how each hedge reduces risk metrics.

Real Estate and Alternative Investments

- InClass

- OutClass

- Tool Training

- Capstone Project

How to Identify Opportunities in REITs

- Evaluate NAV, FFO, and cap rates for real estate valuation

- Analyze market cycles, leverage, and liquidity risks

- Craft diversified REIT strategies across property sectors

How to Diversify Portfolios with alternate investments

- Apply Modern Portfolio Theory and risk parity in diversification

- Explore private equity, hedge funds, and real assets

- Integrate crypto, distressed assets, and alternatives for alpha generation

WealthPreneur: Build Your Own Wealth Management Firm

- Client Strategies and Portfolio Management

- Create Client Acquisition Strategies: Develop marketing and sales plans to attract clients.

- Design Investment Portfolios: Tailor portfolios to clients' goals and risk tolerance.

- Integrate Technology: Implement financial management software for efficient operations.

- Develop Risk Management Systems: Monitor investment performance and ensure compliance.

Bloomberg Lab – Financial Markets Exploration

- Navigate Bloomberg terminals and interpret live market dashboards

- Analyze equity, fixed income, and commodity data using Bloomberg functions

- Track macroeconomic indicators, FX movements, and news sentiment

- Generate custom reports and analytics for market summaries

Real Estate Evaluation & Investment Decision Framework

- Synthesize practical real estate finance, valuation, macro reasoning, and strategic decision-making.

Cryptocurrency, PEVC and Global Investment Strategy

- InClass

- OutClass

- Tool Training

- Capstone Project

How to master the Basics of Blockchain and Cryptocurrencies

- Uncover blockchain fundamentals and the power of decentralization

- Compare crypto and stock markets through a trader’s lens

- Learn crypto trading, mining, and risk psychology

How to Trade Crypto Like a Pro: Advanced Strategies and Risk Management

- Decode crypto price drivers using technical and fundamental analysis

- Master futures, options, and margin trading in digital assets

- Design short- and long-term crypto trading strategies

- Navigate legal, tax, and security challenges in the crypto economy

WealthPreneur: Build Your Own Wealth Management Firm

- Targeting HNWIs and Pilot Program Execution

- Develop HNWI Strategies: Tailor services to attract high-net-worth individuals.

- Launch Pilot Program: Offer services to select clients for practical experience.

- Evaluate Performance: Assess pilot outcomes and gather client feedback.

- Prepare for Official Launch: Refine strategies and operations based on feedback.

Bloomberg Lab – Advanced Market Analytics

- Conduct peer comparison and valuation analysis using Bloomberg tools

- Evaluate portfolio performance, risk metrics, and correlations

- Integrate APIs to fetch real-time market data for strategy execution

- Use Bloomberg Excel add-ins for data extraction and modeling

- Design strategy backtests and market event analyses with Bloomberg datasets

PE/VC Deal Evaluation, Term Sheet Construction & Public Market Strategy

- Evaluate one real-world startup deal, perform a concise investment analysis, construct a basic VC term sheet, and build your execution thesis

Disclaimer: The curriculum is indicative and subject to ongoing refinements based on inputs from industry experts

Enrollment Checklist

Admissions Criteria

Application

Timeline &

Process - Cohort 3

| Rounds | Application Deadline | Interviews | Application Fees | Status | Action |

|---|---|---|---|---|---|

| Round 1 | 25th Feb'26 | Mar'26 | INR 500/- | Active | Apply Now |

01.

Complete the

Application

01.

Complete the

Application

Applicants will need to fill out and submit an online application to be considered for the Masters’ Union PGP in Capital Markets & Trading Programme

Requirements:

-

Personal Details

-

Professional Details

02.

Online

Interview

02.

Online Interview

If shortlisted, applicants will be invited for an online interview, which will help us get to know them better, and help them understand all aspects of PGP in Capital Markets & Trading. The interview panel will consist of our eminent Masters from academia and the industry, as well as members of the core team.

03.

Final Admission

Decision

03.

Final Admission

Decision

Once the Admissions Office receives feedback from the panel, the application will be re-evaluated and then presented to the Admissions Committee, which makes the final decision for each candidate. Applicants will be advised of the final decision on their application through an email.

The entire admissions process, from the Application Deadline, will take up to 4 weeks.

Fee Structure

|

Non-Refundable Admission Fee |

Tuition Fee | Total Fee Payable |

|---|---|---|

| INR 50,000/- | INR 20,50,000/- | INR 21,00,000/- |

The fee mentioned above is GST-exempt

Investing in Your Future

100%

Maximum merit-based programme fee received by a student.

90+

Scholarships available for the postgraduate batch.

100%

Loan coverage for the programme fee .